Machinery & Equipment

Electric Pruning Shears: Labor-Driven Upgrade, Service-Led Market Growth to 2032

04 February 2026

February 4, 2026—APO Research, Inc. stated in its 2026 assessment that, In 2025 the global Electric Pruning Shears market delivered about US$190 million; it is expected to reach around US$210 million in 2026 and approach US$320 million by 2032, with the market projected to grow at a CAGR of approximately 7% from 2026 to 2032. In day-to-day buying discussions, electric pruning shears are treated less as a “tool upgrade” and more as a productivity and labor-risk hedge for vineyards, orchards, and professional landscaping crews, where consistent cut quality, fatigue reduction, and predictable uptime translate directly into controllable cost per hectare and lower peak-season execution risk.

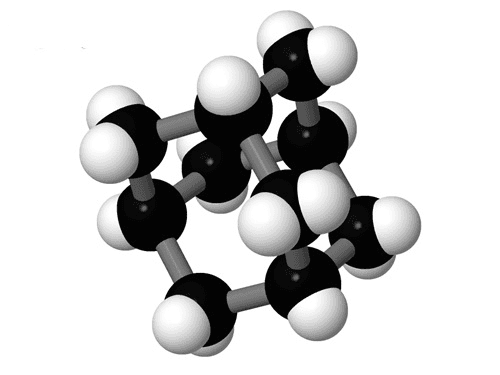

Electric pruning shears are handheld, powered cutting tools designed to prune branches and stems by driving a scissor-like blade mechanism with an electric motor—typically supplied by a rechargeable battery—so the user can achieve higher cutting force, faster cycle time, and reduced hand fatigue compared with manual pruners. They are defined in practice by maximum cutting capacity, blade geometry and safety interlocks, powertrain type (motor, gearbox, actuation), duty cycle and thermal protection, and their suitability for horticulture, vineyards, orchards, and landscaping work.

Unit momentum supports that framing: shipments were about 377 thousand units in 2025 and are expected to be around 400 thousand units in 2026, with annual shipments likely moving beyond 0.55 million units by the end of 2032. A meaningful portion of demand is replacement and fleet redundancy rather than pure greenfield adoption, because battery packs, blades, and drivetrain parts have real wear profiles under high-cycle work, and buyers routinely price in spare tools, spare batteries, and service lead times to avoid downtime during compressed harvest and maintenance windows.

From the most decision-relevant end-market cut, vineyards remain the market’s anchor. In 2026, vineyards contribute about US$85 million, close to 40% of global value; orchards are around US$48 million; landscaping is about US$44 million; and olive orchards are roughly US$34 million. This mix matters for product definition: vineyards reward thermal stability and blade life at sustained cycle rates, orchards and olive work reward torque headroom and hard-wood handling, while landscaping rewards weight, balance, and all-day ergonomics that reduce operator churn and injury risk.

On the technology route, corded models still hold a slight value lead in 2026 at about US$113 million versus cordless at around US$98 million. Corded platforms continue to win where continuous duty, steady torque, and predictable runtime are non-negotiable, but cordless penetration keeps rising as Li-ion ecosystems, BMS robustness, and fast-charging workflows mature. In procurement practice, many professional users converge on a mixed fleet strategy: high-durability platforms for peak workloads, complemented by lighter cordless units for dispersed plots and mobility-intensive tasks, with battery management and spare-part availability treated as core operational requirements rather than afterthoughts.

The supplier landscape spans premium specialists such as Infaco and Pellenc, global power-tool brands including Makita, STIHL and Bosch, and a long tail of regional manufacturers such as Grupo Sanz, Felco, Lisam, Campagnola, Davide e Luigi Volpi Spa, AIMA Srl, Zhejiang Dongqiao Machinery, Dongcheng, Jacto, Zenport Industries and Guyuehu. The market is not highly consolidated, and purchase decisions typically hinge on service readiness and parts availability as much as headline specs; from a manufacturing perspective, the battery system, brushless motor and gearbox, heat-treated blade steel, contamination resistance against sap and dust, and field-repairable design together define the true cost curve and brand credibility. Europe remains the most concentrated profit pool for professional-grade demand, while China’s scale and channel efficiency continue to accelerate penetration and price-performance competition.